Can the Bullish Engulfing Pattern Still Beat the Market in 2026

Don’t we all like clarity in uncertain times? Technical traders are the same, looking for patterns that offer clarity when the markets are uncertain. Can an 18th century technique still work on modern markets? Let’s see if its powers have remained or faded over time. Here, we will cover whether the Bullish Engulfing pattern can still beat the market in 2026.

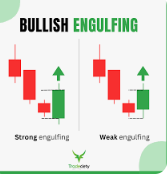

What is the Bullish Engulfing Pattern?

This is a two-candlestick pattern where a small bearish candle is completely overtaken by a large bullish candle. So, it opens lower than the previous day’s close and closes higher than the previous day’s opening. In a span of two candles, the narrative’s been flipped, from sellers being in control one moment to buyers dominating the market.

Traders generally look for this pattern near support zones, when sellers are anticipated to lose their grip, or when volume spikes. This pattern works like a psychological switch, from selling fears to immediately generating buying interest.

Now it can also appear during sideways markets or without supporting volume, in which case smart traders would ignore it. Because it matters when and where the pattern shows up. For it to be relevant, it needs a critical moment such as support zones, oversold decline, and or volume surge.

Does the Bullish Engulfing Pattern Still Work in 2026?

There have been several studies done on this pattern. A global backtest found that the Bullish Engulfing Patternhad a nearly 55% success rate, leading to average gains of roughly 3.5% when traded with simple rules.

In a 2026 study of 5 Nifty 50 stocks, the Bullish Engulfing Pattern showed “repeatable, statistically relevant” tendencies. Admittedly, it is a small dataset of only 5 equities, but the pattern does exhibit its fundamental qualities even under modern conditions.

Where it works:

1. Oversold markets with expanding volume

These setups have shown the most reliability across timelines. Prices have fallen rapidly and by a lot, which one can measure using the Relative Stock Index (RSI)-generally below 30.

2. Trend-filtered opportunities

When the market is in an uptrend and a pullback occurs, the appearance of a Bullish Engulfing Pattern often marks the resumption of the bullish trend. This generally improves success probabilities because you’re using three factors: trend direction, pullback exhaustion, and bullish reversal.

3. Event-driven selloffs

After an unexpected news-driven drop, an engulfing pattern could mark a reversal.

Smart traders often utilise these scenarios and combine them with the best screener for Indian stocksto quickly identify setups that meet all three conditions.

Where it fails:

- A study found that without filters, the effectiveness of the Bullish Engulfing Pattern was insignificant.

- Another situation it doesn’t seem to be very effective in is mean-reverting intraday markets. They produce engulfing patterns often without any meaningful indication as they lack order-flow strength.

Can it Beat the Market in 2026?

In 2026, the Bullish Engulfing Pattern can still offer benefits, provided it is used in the right context. That context includes volume confirmation, alignment with the broader trend, and awareness of the prevailing market regime. Also, as is the case with any trading strategy, proper risk management must be carried out with tight stops.

Conclusion

Bullish Engulfing Pattern is a tactical edge, but not a full trading system. While it has stood the test of time, its real value lies in how it’s applied rather than blind reliance. In uncertain times, you will find clarity not in the isolation of a single pattern, but in the integration of said pattern into a structured system.